360° Financial Trend Detection

360° Financial Trend Detection

Decentralized finance has a glaring, persistent user interface problem. For years, the promise of a new financial system has been gated behind a labyrinth of browser extensions, seed phrases, and gas fees that feel more like a tollbooth on a road to nowhere. The learning curve isn't just steep; for most people, it's a sheer cliff face. This is DeFi's original sin: it built a revolutionary engine but forgot to install a steering wheel, pedals, or even a door.

Enter EVAA Protocol. On the surface, it’s another lending platform in a sea of them. But its core strategy isn't about inventing a novel financial primitive. It's about distribution. By embedding itself directly into Telegram, a messaging app with a user base nudging past one billion, EVAA is attempting to solve DeFi's onboarding crisis by simply bypassing it. It's a Trojan Horse strategy: wheel a user-friendly, gamified app into the walled city of the world’s largest messaging platforms and see if an army of DeFi users pours out.

The on-paper metrics are designed to impress. Since its 2024 launch on the TON blockchain, the protocol claims to have processed over $1.4 billion in transactions and onboarded more than 300,000 wallets. It's attracted backing from some sharp names, including Animoca Ventures and TON Ventures, with a recent TON DeFi lender EVAA Protocol raises $2.5 million in private token sale. But the central question remains. Is this genuine, sustainable adoption, or is it just the financial equivalent of a viral mobile game—a brief flare of activity driven by incentives, destined to fade when the next shiny object appears?

EVAA’s model is less about financial engineering and more about behavioral psychology. It’s a page ripped straight from the Web2 growth-hacking manual. Instead of spending millions on marketing to lure crypto-natives from Ethereum or Solana, they’ve gone fishing in the largest, most accessible pond imaginable: Telegram. The integration is seamless. No new apps to download, no complex setup. It just… works, right inside the app people already use for hours every day.

This approach is like putting a sophisticated derivatives trading desk inside a slot machine. The interface is simple, gamified with XP points and NFT multipliers, making it feel intuitive and rewarding. But underneath, it’s facilitating complex financial transactions like lending, borrowing, and even leveraged liquid staking. The headline numbers reflect the success of this top-of-funnel strategy. They boast of 80,000 monthly active users—to be more precise, the press release cites over 300,000 total wallets onboarded since launch, which paints a slightly different picture of sustained engagement versus initial acquisition.

And this is the part of the analysis that I find genuinely puzzling. The data provided is wide but not deep. We see the total transaction volume ($1.4 billion) and the peak TVL ($118 million), but the crucial metrics that would reveal the health of this ecosystem are missing. What is the average deposit size per user? What is the retention rate for users after their first 30 days? How much of that transaction volume is just a handful of whales looping assets versus broad-based activity? Without this data, it's impossible to distinguish between a thriving micro-economy and a well-designed Skinner box rewarding clicks with token-based stimuli.

The platform's security has been audited by Quantstamp and Trail of Bits (a necessary but never sufficient checkbox for risk management), which lends it a veneer of legitimacy. But the real risk here may not be a smart contract exploit. The risk is that the user base is entirely mercenary, loyal only to the next airdrop or XP reward, with no actual commitment to the protocol itself. Is EVAA building a community or just renting an audience?

The entire operation is clearly building toward a single, pivotal event: the $EVAA Token Generation Event (TGE) slated for October 3, 2025. This is the moment the economic engine is switched on, and it will be the first real stress test of the protocol's underlying value. The announcement that EVAA to Launch Token on Binance Alpha, MEXC, STON.fi, and Gate.io indicates a significant push for day-one liquidity and accessibility.

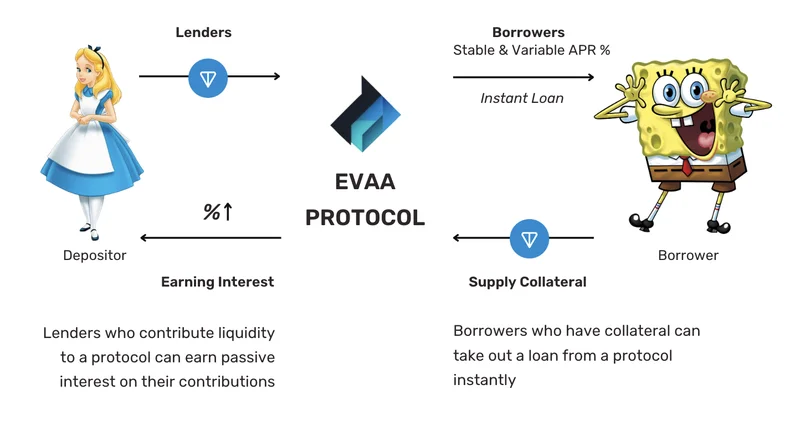

The token’s utility is standard fare for a DeFi protocol. Holders will get reduced borrowing fees, boosted staking rewards, and governance rights. A buyback-and-burn mechanism is also planned to create deflationary pressure. These are sound, time-tested mechanics. But the success of a token is less about its design and more about the demand for the services it governs. If the primary use case for EVAA Protocol is farming the $EVAA token itself, then the entire system becomes a self-referential loop with no external value anchor.

The $2.5 million in venture funding provides a decent runway, but it’s not a war chest. It’s enough to build the product and get to the starting line, but the TGE is the main event. It needs to succeed not just to enrich early investors, but to fund the ambitious roadmap, which includes multichain yield aggregators. That expansion is critical. To survive long-term, EVAA can't just be a "Telegram DeFi app"; it needs to become a core piece of financial infrastructure on TON and beyond.

The introduction of tgBTC—a tokenized version of Bitcoin for use as collateral on TON—is a genuinely clever move. It taps into the largest pool of crypto capital and gives it a productive use case within the EVAA ecosystem. This, more than the gamification, points to a strategy for attracting serious capital. But it also highlights the protocol's central tension: is it for the masses on Telegram earning XP, or is it for Bitcoin whales looking for novel yield strategies? Can it truly be for both?

My analysis suggests that EVAA Protocol has brilliantly solved the customer acquisition problem that has plagued DeFi since its inception. By leveraging Telegram, they've built a distribution channel of unparalleled scale. The user interface is clean, the gamification is sticky, and the on-ramp is virtually frictionless. They have successfully brought the mountain to Mohammed.

But the fundamental question has not yet been answered. Have they built a sustainable economy or just a very efficient marketing funnel? The real test will come in the months following the TGE. Once the initial hype subsides and the airdrop farmers move on, we will see the protocol's true financial gravity. The long-term value won't be measured in the number of wallets onboarded or XP points earned. It will be determined by a far simpler metric: whether the protocol can generate more in fees from genuine economic activity than it pays out in token incentives. The Trojan Horse is at the gates; we're about to find out if it's full of soldiers or just confetti.