360° Financial Trend Detection

360° Financial Trend Detection

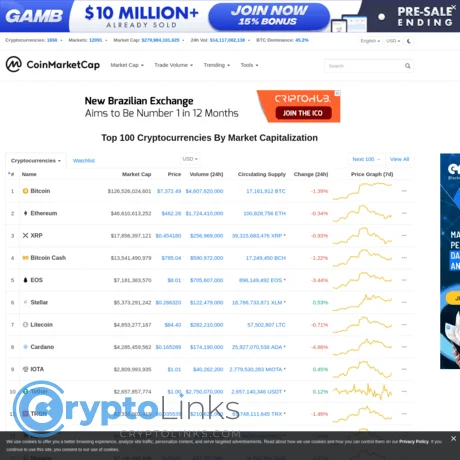

Alright, let's cut through the noise. Every week, I fire up my browser, glance at the `coinmarketcap crypto` list, and feel the same wave of existential dread wash over me. It’s a fresh hell of buzzwords, a new parade of digital messiahs promising to solve problems you didn’t know you had with solutions you definitely don’t understand.

This week is no different. We’ve got a fresh crop of would-be revolutionaries, each with a whitepaper thicker than a phone book and a pitch shinier than a freshly minted NFT. They all want to be the next `bitcoin`, the next big thing you’ll kick yourself for missing. But when you scrape off the marketing gloss, what are you really left with? Let's take a look at the latest contestants in the crypto circus.

First up is Hemi, a project with a pedigree. It’s co-founded by Jeff Garzik, a name that carries weight from his days as a Bitcoin core dev. Their pitch is to stitch Bitcoin and Ethereum together into a "single supernetwork." They’re throwing around terms like "Hemi Virtual Machine" and "Proof-of-Proof Consensus."

Let’s be real. "Proof-of-Proof" sounds like something a marketing intern came up with after three Red Bulls. It’s a tautology dressed up as innovation. The whole project feels like trying to build a supercar by welding a Tesla battery onto a Ford Model T. Sure, both parts were revolutionary in their time, but does smashing them together create a functional vehicle or just a really interesting explosion? Having a big name attached is great for the initial `crypto news` hit, but what happens when the rubber actually has to meet the road? Is this a genuine leap forward, or just a complex solution in search of a multi-million dollar funding problem?

On the other end of the spectrum, you have Axelar. This one isn’t a mad scientist’s dream; it’s the clean, corporate, VC-backed darling. It’s got `Coinbase` Ventures and Binance in its corner, promising "secure cross-chain communication." It’s the kind of project that gets a slick presentation at a conference and makes institutional investors feel safe.

But we've seen this movie before. "Secure cross-chain" is the crypto equivalent of a politician promising to lower taxes. It sounds great, everyone wants it, and it’s almost impossible to deliver without something blowing up. The graveyard of hacked bridges is overflowing. So, while Axelar has the capital and the connections, what makes them immune? When the VCs who got in early decide to dump their AXL tokens, who’s going to be left holding the bag?

Then we get to the funhouse mirror section of the crypto world, starting with Cheems. This is a memecoin that wears its heart on its sleeve. It’s for everyone who "got fucked by Doge." It’s a support group with a token attached. Their pitch is pure emotion: "Cheems ain’t about pump and dump... Cheems is purely here to remind you people who is the Lord of Memes."

This is, in its own twisted way, almost refreshing. It’s a grift that admits it’s playing on your feelings. It's like a con artist looking you dead in the eye and saying, "I'm going to take your money, but we're going to have a laugh while I do it." They promise no team reserves, no taxes, just 100% vibes. But a community built on shared financial trauma is still a house of cards. Is this really a movement, or just a clever way to repackage the same speculative gambling that burned people in the first place?

And then there's Falcon Finance. I went to their page on a crypto tracker, and what did I find? No revolutionary tech, no roadmap to the moon, no cringey memes. I found a cookie policy.

That’s it. A boilerplate, legal-ese-filled explanation of how they might store information on my browser. This is a bad joke. No, "bad" doesn't cover it—this is a masterpiece of unintentional satire. In a world of over-the-top promises, Falcon Finance offers you nothing but a privacy disclaimer. Honestly, its a perfect encapsulation of the entire market: a complex, opaque system you don’t understand, asking for your consent before it does God-knows-what with your assets. I almost respect it.

Finally, we have DoubleZero, which is trying to solve the problem of… the internet being too slow for crypto. They're building a "high-performance global network" with "contributed fiber links" to cut down on latency for validators and on-chain traders. It’s built on Solana, which offcourse makes sense given the `Solana coinmarketcap` hype is all about speed.

This is the "plumber" pitch. They’re not selling you gold; they’re selling you faster, shinier shovels. And I’m sure for the ten people in the world running high-frequency arbitrage bots, this is a godsend. But for everyone else? It’s like selling F1 racing fuel to someone who uses their car to get groceries. Are we really at a point where the most pressing issue in this revolutionary new financial system is shaving a few milliseconds off a transaction time? Are we just building a faster, more exclusive highway for digital beanie babies to crash into each other?

They talk about token-incentivized bandwidth and a two-ring network architecture, but at the end of the day... it just feels like another layer of abstraction, another token to speculate on, built to fix a problem that only exists within its own hermetically sealed ecosystem.

So what's the takeaway from this week's batch of hopefuls? It's the same story, just with a different cast of characters. You have the legacy-backed academic project, the VC-funded corporate play, the self-aware memetic joke, and the hyper-niche infrastructure build. They all use different language, but they’re all playing the same game: capture attention, create a token, and build a narrative strong enough to get people to buy in. Maybe I'm just the cynical one here, the old man yelling at a cloud of decentralized protocols. Or maybe, just maybe, I’ve seen enough cycles of this to know that the tech is almost always secondary to the speculation. The real product is, and always has been, the token.