360° Financial Trend Detection

360° Financial Trend Detection

So, you thought your magic internet money was a hedge against the whims of powerful old men? Cute.

I bet you were feeling pretty damn smart last week. Bitcoin was screaming past $126,000. The "euphoria phase," the analysts called it, with their slick charts and confident predictions of $200k by Christmas. You probably checked your Blockfolio app every ten minutes, watching the little green numbers go up, feeling like a financial titan.

Then you got a push notification. Why Is Crypto Down: Bitcoin (BTC) Down 10%, ETH, XRP, SOL in Freefall on Trump Tariff.

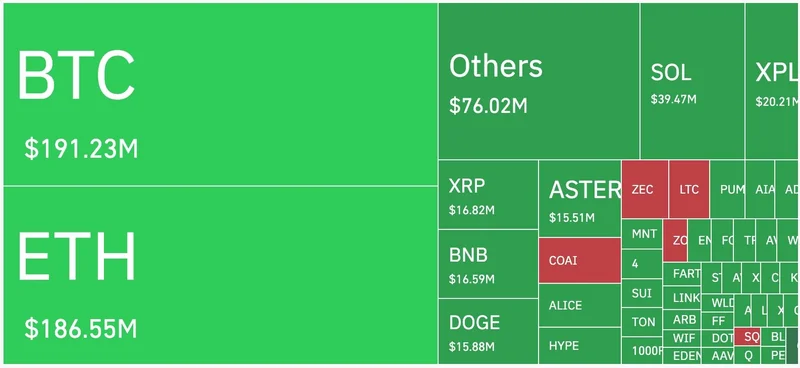

And in the time it takes to read 280 characters, the entire market decided to swan dive into an empty swimming pool. Bitcoin shed 10% like it was last season's fashion. Your altcoin bags, the ones you swore had "good fundamentals," probably bled out 30% or more. Welcome to the real world, kid. The one where a septuagenarian's tantrum on a second-rate social media app can vaporize billions of dollars in wealth before you've finished your morning coffee.

Let's be brutally honest about what happened. This wasn't some complex market dynamic or a sophisticated correction. This was a bar fight, plain and simple. China makes a move on rare-earth minerals, and in response, President Trump logs onto Truth Social and threatens a 100% tariff on basically everything with a "Made in China" sticker on it.

A 100% tariff.

Just let that sink in. That's not a policy; it's a declaration of economic war typed out on a smartphone. It's the financial equivalent of flipping over the Monopoly board because someone bought Boardwalk and Park Place. I can just picture the scene: some intern frantically fact-checking while the President hits "Post," and in trading houses from New York to Hong Kong, algorithms start screaming, dumping everything that isn't nailed down.

And what gets dumped first? The riskiest assets on the planet. Your beloved Bitcoin went from a cool $117,000 to scraping the pavement at $108,000. Bitcoin Price Dumps To $108,000, Trump Puts Tariffs On China. You could practically hear the collective gasp of every HODLer on the planet. This is the part the crypto gurus don't put in their YouTube thumbnails, isn't it? The sheer, gut-wrenching volatility that comes when the real world crashes the party. They sell you a dream of a decentralized utopia, but at the end of the day, your portfolio is still beholden to the same old power games it was supposed to replace.

For years, we've been fed this line that Bitcoin is "digital gold." A safe haven asset that protects you from inflation and geopolitical chaos. Well, the chaos arrived right on schedule, and what did Bitcoin do? It curled up in the fetal position right alongside the S&P 500 and the Nasdaq.

This is a bad look. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire for the entire "uncorrelated asset" narrative. When the chips were down, crypto behaved just like every other panicked tech stock, only with more leverage and zero circuit breakers. Stocks like Coinbase and MicroStrategy got hammered, proving that the umbilical cord connecting crypto to the traditional financial system is shorter and thicker than anyone wants to admit.

It's all part of a grand plan, offcourse. The true believers will tell you this is just shaking out the "weak hands." They'll post diamond-hand emojis while their net worth gets sliced in half. But who are we kidding? This euphoria phase wasn't about a belief in a new financial paradigm. It was about greed. Pure, uncut, number-go-up greed. And when the music stops, everyone rushes for the same tiny exit door. It’s like watching a game of musical chairs where the prize is not getting financially obliterated.

They tell us this is all part of some grand 4D chess match, but from down here it just looks like two guys throwing rocks at each other's greenhouses... and our life savings happen to be inside. I mean, give me a break. My grocery bill is already a joke, and now we're talking about doubling the price of everything from iPhones to cheap plastic toys? This ain't just about digital tokens anymore.

Here's the scariest part: none of this has even happened yet. The tariffs and the export controls don't kick in until November 1st. What we just witnessed was the preview. The trailer for the feature-length disaster film. The market isn't reacting to a new reality; it's reacting to the threat of a new reality.

What does that mean for the moon-boys and their $200k price targets? It means their predictions are about as useful as a screen door on a submarine. How can you chart a future when the entire map can be redrawn by a single angry post? You can’t. You're just gambling. You're betting that the people in charge won't get any crazier than they already are, which, historically speaking, is a terrible bet to make.

Maybe this is the great filter for crypto. A test to see if it can survive in a world that's actively hostile and unpredictable. Then again, maybe I'm the crazy one here. Maybe this chaos is exactly what Bitcoin was built for, and in six months we'll all look back at this day and laugh from our Lambos.

Or maybe we're just rearranging deck chairs on the Titanic, arguing about which blockchain has better transaction speeds while the whole ship goes down.

Let's stop pretending. Whether it's stocks, crypto, or pork belly futures, we're not "investors" in some grand project of human progress. We're gamblers. We're sitting at a massive, global poker table where the house—a handful of politicians and central bankers—can change the rules, print more chips, or just flip the table over whenever they feel like it. The "euphoria" was just a hot streak. This is the cold, hard reality of the morning after. Don't ever forget it.