360° Financial Trend Detection

360° Financial Trend Detection

Of course. Here is the feature article written in the persona of Dr. Aris Thorne.

*

When I first saw headlines like High-Flying Tech ETFs See $14 Billion Exodus – Why Investors Are Bailing on TQQQ & SOXL’s Rally, my initial thought was, "Here we go again, the fear is setting in." It’s a familiar story. A technology sector gets white-hot, speculators pile in with borrowed money and risky tools, and then, at the first sign of turbulence, they flee for the exits. It’s the classic boom-and-bust cycle that has defined financial markets for centuries.

But the more I dug into what’s happening with ETFs like TQQQ and SOXL, the more I realized I was looking at it all wrong. This isn't the story we think it is.

Yes, the numbers are staggering. The ProShares UltraPro QQQ (TQQQ), a fund designed to give you three times the daily return of the Nasdaq-100, is up a whopping 37% this year. The semiconductor-focused version, SOXL, has soared over 50%. These are incredible gains, fueled by an AI revolution that is genuinely reshaping our world. Nvidia is firing on all cylinders, AMD is striking massive deals with OpenAI—the technological progress is real, tangible, and accelerating. Yet, traders have pulled a combined $14 billion out of these two funds.

The easy conclusion is that the "smart money" is calling the top. That the retail traders who rode this wave are now spooked, cashing in their chips before the whole thing comes crashing down. But what if that’s not it at all? What if we're witnessing something far more interesting—not a retreat from technology, but an evolution in how we invest in it?

To understand what’s happening, you have to understand what these leveraged ETFs actually are. Think of them like the booster rockets on a massive spacecraft. They are packed with explosive fuel, designed for one purpose: to provide an immense, powerful, and short-lived burst of thrust to break through the atmosphere. They are not, however, designed for the long, steady journey to the stars.

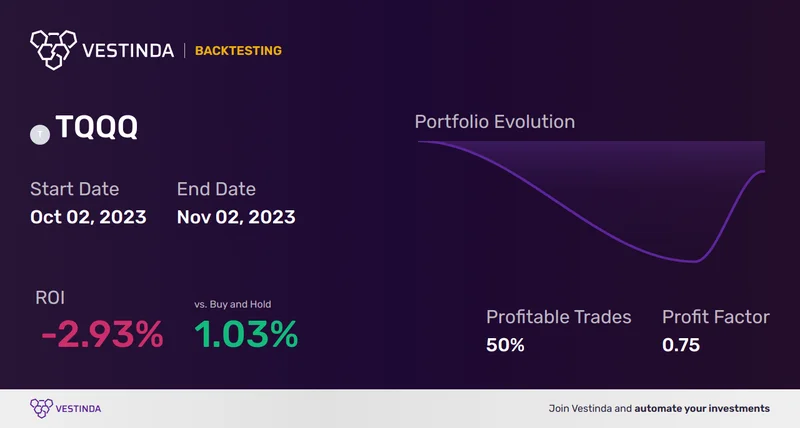

TQQQ and SOXL are financial booster rockets. They use derivatives and debt to magnify daily returns, making them incredibly potent for short-term trades. But they come with serious risks. They suffer from something called "volatility drag"—in simple terms, the complex math of resetting their leverage every single day means that in a choppy market, your long-term returns can get eaten alive, falling far short of the promised "3x" multiple. After the brutal crash of 2022, where TQQQ lost 82% and SOXL an astonishing 91%, traders who bought the dip are now sitting on huge profits. And they’re wisely choosing to detach the boosters.

This is the kind of breakthrough that reminds me why I got into this field in the first place. We're not just seeing technological intelligence advance; we're seeing human intelligence evolve alongside it. This isn't the blind panic of past bubbles. This is a calculated, strategic maneuver. Investors are taking their speculative winnings off the casino table. The crucial question isn't why they're selling, but where is that $14 billion going next? Is it vanishing into mattresses and gold bars, or is it being redeployed with a new, more mature strategy?

I keep thinking back to the dot-com bubble. Back then, the excitement was also about a world-changing technology—the internet. But the investment landscape was a frenzy of speculation on companies with no products and no profits. When it burst, it wiped out true believers and gamblers alike, poisoning the well for tech investment for years.

This feels different. The AI boom is real, the breakthroughs in machine learning and processing power are happening at a pace that is frankly hard to keep up with and it's changing everything from drug discovery to how we write code—it's a genuine paradigm shift, not just a stock market story. The companies at the heart of this revolution, the Nvidias and Microsofts of the world, are generating astronomical profits.

What we're seeing with these ETF outflows isn't a rejection of that fundamental reality. It's an embrace of it. It’s a sign that a growing number of investors are graduating. They’re moving from the high-risk, short-term gambling of leveraged ETFs to, I believe, direct, long-term investment in the foundational companies building our future. They used the boosters to get into orbit, and now they’re ready for the actual journey. They’re selling the bet on the Nasdaq and buying the builders of the new economy.

This is an incredible signal of maturity. It suggests that people are learning the hard-won lessons of the past. You don’t need to gamble with 3x leverage on a revolution this profound. You just need to be a part of it. The real wealth, the kind that builds over a generation, won't come from timing the daily swings of TQQQ. It will come from owning a piece of the companies that are laying the groundwork for the next century.

So, are these outflows a warning sign? A canary in the coal mine? I don't think so. I think it’s the sound of capital getting smarter. It’s the sound of investors looking past the sugar rush of daily leverage and focusing on the enduring, world-changing meal that is the AI revolution.

Let's be clear. This $14 billion exodus isn't a vote of no confidence in the future of technology. It's the exact opposite. It's a sign that the AI revolution has become so undeniable, so fundamentally real, that investors are shifting from short-term speculation to long-term conviction. They are trading in their lottery tickets for ownership stakes. This isn't fear. It's the beginning of wisdom.