360° Financial Trend Detection

360° Financial Trend Detection

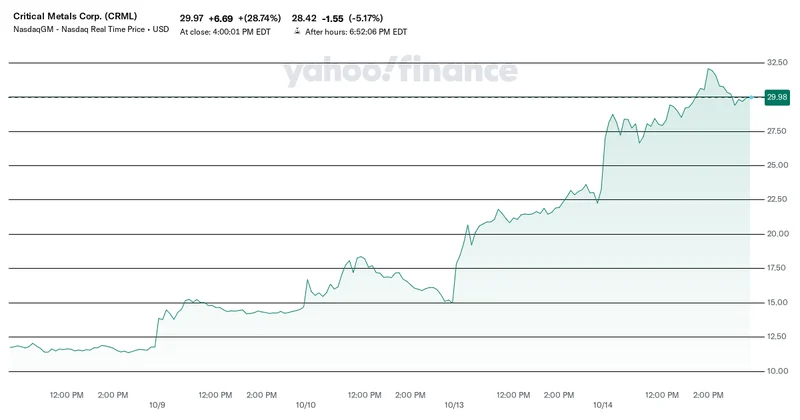

Let’s be precise. In the final week of March, you could have purchased a share of Critical Metals Corp. (CRML) for less than a dollar. As of this week, that same share has traded at over $21. That’s a gain of more than 2,200%. A stock doesn't move like that on fundamentals alone. This isn't a story about discounted cash flows or EBITDA multiples. This is a story about narrative—a powerful, perfectly-timed confluence of geopolitics, institutional signaling, and speculative fervor.

The question isn't whether the catalysts are real. They are. The question is whether the market's reaction is proportional to the underlying reality. My analysis suggests a significant discrepancy.

We are observing a classic case of narrative-driven price discovery, where the story has become so compelling that it has completely detached from conventional valuation metrics. And when that happens, an analyst's job is to measure the gap between the story and the balance sheet.

The ascent of Critical Metals wasn't driven by a single event, but a rapid-fire sequence of them. First, you have the macro-political layer. Former President Trump’s rhetoric around imposing 100% tariffs on China in response to its export controls on rare earth elements served as the initial accelerant. Beijing’s subsequent move to regulate not just the minerals but the technology and labor used in refining them added fuel to the fire. This geopolitical tension is the bedrock of the CRML bull thesis: as China weaponizes its dominance in the rare earth supply chain, Western alternatives become strategically priceless. Critical Metals, with its flagship Tanbreez Project in Greenland (one of the world's largest heavy rare earth deposits), is positioned as the perfect antidote.

Then came the institutional validation. JPMorgan Chase announced it would invest up to $10 billion in industries critical to U.S. national security, explicitly naming critical minerals as a primary focus. The bank's CEO, Jamie Dimon, provided the soundbite that launched a thousand buy orders: “It has become painfully clear that the United States has allowed itself to become too reliant on unreliable sources of critical minerals.” This wasn't just a funding pledge; it was a flashing neon sign from the heart of Wall Street, legitimizing the entire sector and, by extension, a visible player like CRML.

Finally, the company-specific news landed. A letter of intent for a 10-year off-take agreement with REalloys Inc. for 15% of the Tanbreez Project's projected output. This provided a tangible, fundamental anchor to the soaring narrative. Over the term, this deal represents about 6.75 million metric tons of concentrate. So, we have a three-layer cake of catalysts: a geopolitical imperative, a massive institutional capital pledge, and a specific commercial agreement. It’s no wonder the stock went vertical.

This is the part of the analysis that I find genuinely puzzling. For all the explosive price action and compelling narrative, the institutional research is practically non-existent. The data shows a "Moderate Buy" consensus rating based on a grand total of one analyst. One. And that single analyst’s price target is $14.00 per share. At the time the stock was trading around $21—to be more exact, a high of $22.08—that price target implied a 40% downside risk.

How does one reconcile this? How can a stock be a "Moderate Buy" while also being priced 40% above its target? It suggests the analyst is either catastrophically behind the news cycle or, more likely, that their model is based on fundamentals that the market has decided to completely ignore. The market is pricing in a perfect-world scenario: the Tanbreez project comes online without a hitch, geopolitical tensions remain white-hot, and JPMorgan’s capital flows directly and efficiently into companies like CRML.

The absence of broader Wall Street coverage is, for me, the most significant red flag. It indicates a lack of institutional oversight, limited transparency, and a high degree of execution risk that hasn't been modeled or vetted. Without multiple sets of eyes scrutinizing cash burn, operational timelines, and the capital-intensive reality of mining, investors are flying blind. They are trading a story, not a company.

Think of CRML as a speculative rocket. The first stage booster was the China tariff talk. The second stage was the JPMorgan announcement. These are powerful, narrative-based engines that have propelled it into an incredible trajectory. But rockets need a final stage engine—one built on the solid, reliable mechanics of production, revenue, and profit—to achieve a stable orbit. Right now, that final stage is still just a blueprint (the Tanbreez project). The market has priced the stock as if it's already in orbit, when it hasn't even cleared the atmosphere. What happens if there's a delay in construction, a shift in political winds, or if rare earth prices normalize? The narrative fuel burns out fast.

The surge in Critical Metals stock is a masterclass in how modern markets function. Geopolitical narratives and institutional signaling can, in the short term, overwhelm any semblance of fundamental valuation. The thesis is seductive: a North American rare earth champion, backed by the biggest bank in the country, at a time of peak tension with the world’s dominant supplier. It’s a story that sells itself.

But a story is not a substitute for a discounted cash flow model. The current valuation leaves absolutely no room for error. It assumes flawless execution on a massive, capital-intensive mining project. It assumes continued, unwavering policy support. And it assumes that the current frenzy is sustainable. The single analyst covering the stock is whispering a word of caution with that $14 price target, but in a market this loud, it’s hard to hear. The risk here isn't that the story is wrong; it's that the price has already baked in the happiest possible ending.