360° Financial Trend Detection

360° Financial Trend Detection

# NuScale's $13 Billion Valuation: A Story of Two Conflicting Datasets

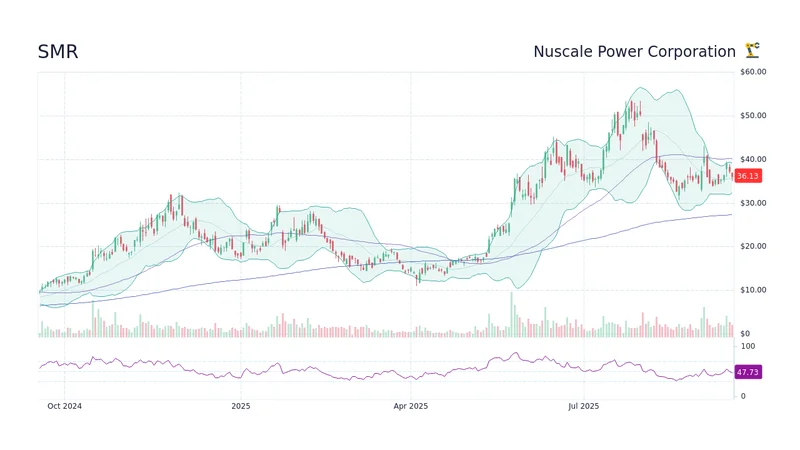

On October 13, 2025, the ticker for NuScale Power (NYSE: SMR) did exactly what speculative tech investors dream of. The stock surged 14.3% in a single day, briefly touching $46.40 on a torrent of trading volume—about 30 million shares, a stark deviation from its average. You can almost hear the frantic clicking of buy orders as the news of a landmark deal with the Tennessee Valley Authority (TVA) solidified a narrative years in the making.

This isn't just another clean energy company. NuScale represents the vanguard of the Small Modular Reactor (SMR) revolution, a promise to make nuclear power cheaper, safer, and faster to build. With the U.S. Nuclear Regulatory Commission's stamp of approval on its 77 MWe design (the only one of its kind), the company holds a powerful, tangible advantage. The market has responded accordingly. From a $10 IPO in May 2022, the stock has climbed to around $45, minting a market capitalization fluctuating between $12 and $13 billion.

The story is, frankly, perfect. An energy-hungry world, spooked by climate change and geopolitical instability, is rediscovering nuclear power. Tech giants are crying out for carbon-free, 24/7 baseload energy to power a new generation of AI data centers. And here comes NuScale, holding the only government-certified key to the kingdom. It’s a compelling thesis. But my job is to look at all the data, especially the numbers that don't fit neatly into the press release. And when I look at NuScale, I see two distinct, and frankly conflicting, datasets.

To understand the current valuation, you have to appreciate the sheer power of the story being told. The September 2025 announcement of a 6 GW SMR deployment program with the TVA is the centerpiece. This isn't a pilot program; it's billed as "the largest SMR deployment in U.S. history," enough to power millions of homes or dozens of power-guzzling AI data hubs. It transforms NuScale from a promising concept into a company with a monumental backlog.

This deal acts as a powerful accelerant on an already-glowing fire. The AI tailwind is real. When Alphabet’s CFO, Ruth Porat, publicly states that "nuclear has to be a part of the mix," she’s signaling a tidal wave of demand from the most cash-rich sector on the planet. The market is therefore valuing NuScale not as a staid utility component manufacturer, but as the premier picks-and-shovels play for the AI gold rush. It’s like selling server racks in 1999 or GPUs in 2023—the demand story is so overwhelming that it almost eclipses the fundamentals of the product itself.

And unlike many speculative ventures, NuScale’s core advantage is verifiable. Securing the first and only SMR design certification from the NRC is a deep, expensive, and time-consuming moat. It’s a regulatory gauntlet that has tripped up countless others. This approval gives NuScale a multi-year head start, a fact that isn't lost on investors paying a premium for a first-mover in a potentially trillion-dollar industry. The narrative is clear: a unique technology with a government-approved monopoly, meeting an insatiable new demand from the world’s most important industry. From this perspective, is a $13 billion valuation really so outlandish?

This is the part of the analysis that I find genuinely puzzling. While the market was celebrating the TVA deal and pushing the stock to new highs, another set of data points was quietly being filed with the SEC. These numbers tell a story of caution, not euphoria.

First, let's look at Fluor Corp., NuScale’s majority owner and the entity that knows the business most intimately. In early October, just as this monumental news was settling in, Fluor announced it had sold 15 million shares for a net proceed of $605 million. To be clear, they still retain a significant stake (a holding of about 39%), but the timing is conspicuous. Why would the parent company, with the deepest possible insight into NuScale’s operations and future prospects, liquidate over half a billion dollars in stock right when the story has seemingly never been better?

This wasn't an isolated event. SEC filings also show a Fluor-affiliated director sold 2.37 million shares in September for approximately $104 million. Together, these are not minor, scheduled sales for tax purposes. This is significant capital being taken off the table.

Then we have the Wall Street analyst consensus, which presents another major disconnect. Of 15 analysts covering the stock, ten rate it a "Hold." The median 12-month price target sits somewhere between $37 and $40. Let’s be precise: the stock is trading around $45, yet the professionals paid to model its future cash flows believe its fair value a year from now is, on average, 10-15% lower than its current price. While individual price targets vary wildly, from a bearish $28 to a bullish $60, the collective wisdom of the sell-side is flashing a bright yellow light.

So, we have a paradox. The narrative traders see a category-defining company on the cusp of exponential growth. But the insiders and the professional analysts appear to see something else—perhaps a valuation that has gotten ahead of itself. How do we reconcile these two realities? The answer may lie in the one thing the market hates to price in: execution risk. For all the excitement, NuScale has yet to build a commercial reactor. Its first plant isn't slated for deployment until around 2030. And we have a recent, painful data point on this front: the company’s demonstration project in Idaho was canceled in 2023 after projected costs nearly doubled. That history cannot simply be ignored.

My conclusion is this: NuScale Power's current $13 billion valuation is the price of a perfect future. It’s a number that assumes the landmark TVA deal proceeds without major delays or cost overruns, that the five-year path to deployment is smooth, and that the economic model proven on paper translates flawlessly to the complex reality of nuclear construction. It prices in the AI-driven demand but prices out the ghost of the failed Idaho project.

The disconnect between the soaring stock price and the cautionary signals from insider sales and analyst targets isn't a sign that one side is "right" and the other is "wrong." It's a measure of pure risk. The market is betting on a story. The insiders, it seems, are hedging that bet. The valuation doesn't just assume success; it assumes immaculate execution in one of the most difficult heavy-industrial sectors on Earth. And that is a very, very expensive assumption to make.